However, as soon as you get your first paycheck, that all changes, and you realize that life is quite expensive. Now, there are ways in which you can make your money work for you. This is what investing is for. There are risks and benefits to every choice that you make with your dollar since that goes to the free market and updates the prices of all of the products that we use.

The thing about the future is that no one can predict what is going to happen. Even though there is a danger of uncertainty, there is a lot of logic that goes into saving money for retirement. You can go to https://www.metal-res.com/gold-ira/valcambi-gold-combibar/ for more information. When you’re old, you can’t work as much as when you’re younger.

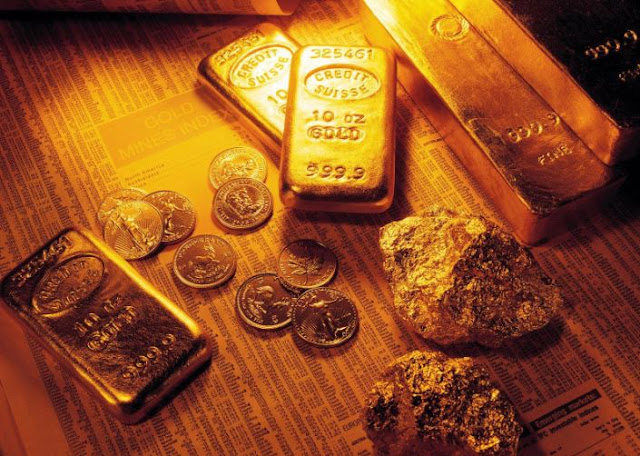

That’s why it’s important to set aside a piece of your earnings now so that you can enjoy it later. That is the principle of delayed gratification. The best tool to achieve financial success has always been gold. Putting part of your money into the yellow metal has a history of more than five thousand years.

The stock market can crash, and a company can go bankrupt. The real estate market can crash, just like it did in 2008. The best example of that is the Lehman Brothers. Bonds can fail too, and that happened in Greece and Argentina. Cryptocurrencies can fluctuate massively within a day or based on a single tweet, and many financial experts say crypto coins could be worthless now or in the near future.

The only thing that has withstood the test of time is gold, and it’s never going to be worthless. Here's how the best strategy works. Even though the price of gold can fall, then your paper and cash assets are going to do outstandingly well. When the bonds and stocks start underperforming, gold will be there to pick up the burden. Having an evenly balanced portfolio is something that you should be striving towards.

Should You Buy Gold?

There is a risk in every activity that we do. If we try to cross the road, a car can be out of control and cause massive damage to our bodies. If we stay at home, a plane can crash in that spot precisely, or an earthquake could come up out of nowhere.

However, if you get trapped in that mode of thinking, you’ll become paranoid because there’s danger everywhere. Life is all about balancing risk and reward. Physical gold has a lot of benefits, but there’s an added risk to it too.

The main hazard in owning physical gold is that it can be stolen from the depository where it is kept. Because that possibility exists, you can choose to insure your storage or IRA, which will secure your holdings.

There’s no reason to be reinventing the wheel when investing has been simplified so much. Another risk is getting your precious metals from an untrustworthy broker or custodian. You don’t want to fall victim to fraud. To avoid that, you need to find a reputable dealer or a custodian that will ensure the transaction. This reduces the risks to zero.

Why Should You Go For A Combibar?

This is the best way to be investing in precious metals. Money by itself needs to be divisible and transportable. The current mode of thinking for plenty of investors is saving enough money to buy bullion.

That’s not the best strategy because it puts you in a tight spot. With such a large investment, you lose access to liquidity. It's just like buying an apartment. Real estate is great when you want to make money from rent, but it’s bad when you need to sell it immediately. You'll always lose on your profits. Gold is the same thing.

Instead of getting single bullion that can’t be divided into smaller pieces, it’s much better to go for the choice where you get a hundred smaller pieces which come to the total of full bullion. The storage space will be completely the same, but you’ll be much safer when you need to sell.

You can’t go to a dealer and sell a third of your bullion. However, you can do that if you purchase it in smaller chunks. Plus, that’s a much better strategy that goes for the dollar-cost averaging principle. Click here to read more.

Final Words On Getting And Growing Gold

When you’re creating a portfolio, it’s wise to talk to a financial counselor. You need to have a general idea of how your entire portfolio is structured. Having a well-diversified strategy is the best option. Going for a third in precious metals, a third in real estate, and a third in stocks is the ideal outcome for plenty of people.

Whenever some sector lags behind, there are two others that keep it breathing and out of the water. All of these asset classes have their bull and bear cycles. It always pays to invest in a field when it starts decreasing.

This means that the other two asset classes are going to become overpriced soon, and during the next bull run, you can make most of your profits. When the price of gold is near an all-time high, it’s a much better option to wait instead of getting it at that time when it can drop dramatically in the near future.